UPDATE 12/28/19: For a detailed walkthrough and instructions for completing the new W-4 for 2020, please read this article.

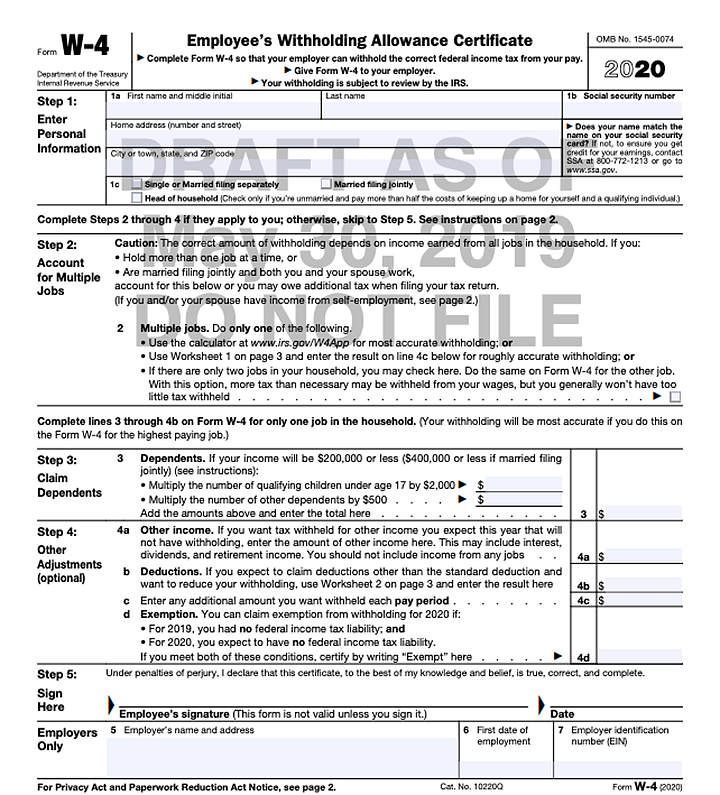

In response to the shock of some taxpayers who are still reeling from the amount due with their 2018 tax returns, the IRS has published a draft of the updated Form W-4, which is used to calculate payroll withholdings for federal taxes. The draft is meant to incorporate many of the changes made by the Tax Cuts and Jobs Act, which dramatically altered the tax landscape for many taxpayers.

The new form is longer than the old form, and there are still a few supporting schedules that will help taxpayers figure their allowances and any additional amount to withhold, but overall it is a step in the right direction.

You can download a full version of the form here. It is important to note that the new form will not be used until 2020, but it’s still not a bad idea to look at it in order to see what’s coming. For a review of some of the bigger changes, and discussion of why this is happening, check out this Forbes article.

I am recommending all clients review their withholding again sometime this summer or early fall in order to make sure their withholdings are tracking correctly to avoid any surprises come next tax season. If you have any questions on your withholding, please feel free to give me a call.