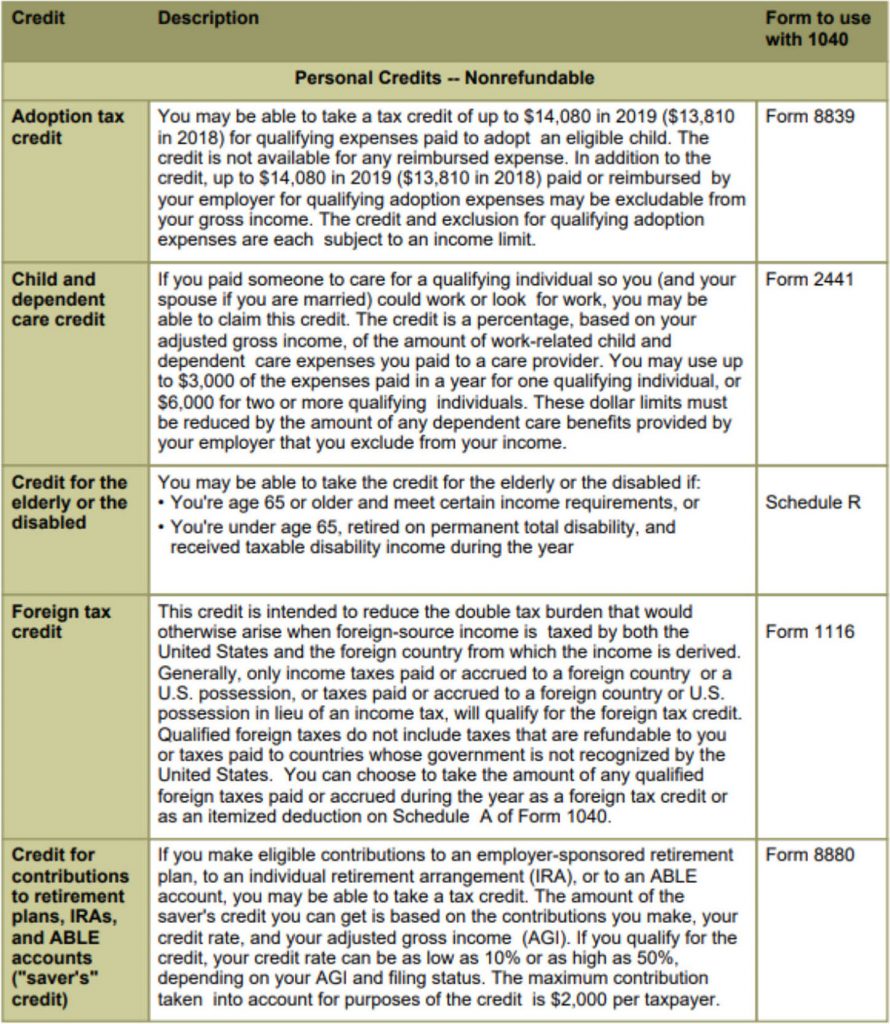

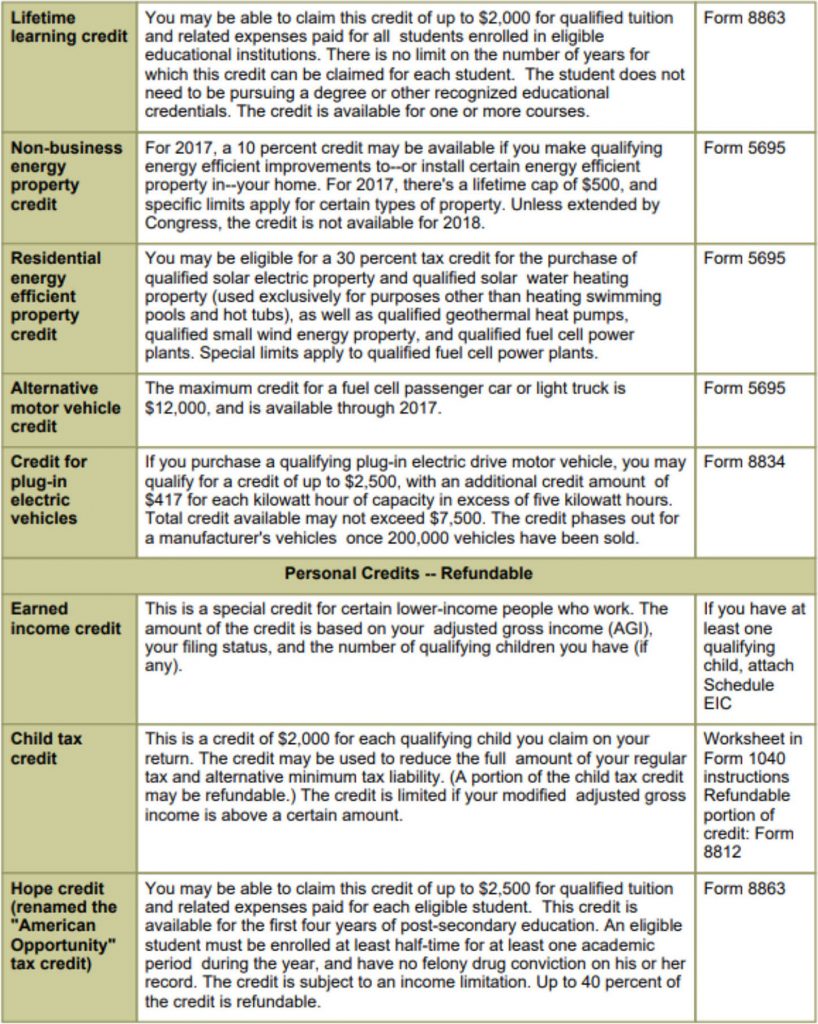

A tax credit reduces the amount of income tax you may have to pay. Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. Most tax credits are nonrefundable: If the credit amount exceeds the tax owed, no refund is given. Refundable credits are different: If the credit amount exceeds the tax owed, a refund may be due to the taxpayer.

While not a comprehensive list, the following personal tax credits are of general interest to individuals: