The Senate passed the “Tax Cuts and Jobs Act” early this morning, and the revote in the House looks like a formality, so soon there will a new law of the land. Regardless of the downstream economic affects of the new law, taxpayers should be aware the provisions that affect them in the near term. What follows is my attempt to summarize the key provisions of the new tax law that may affect my clients. It is by no means an exhaustive list. If you have questions about your specific tax situation, fell free to call or email me. That said, here’s how the tax reform legislation may affect you and your family in 2018 and beyond:

Personal Taxes

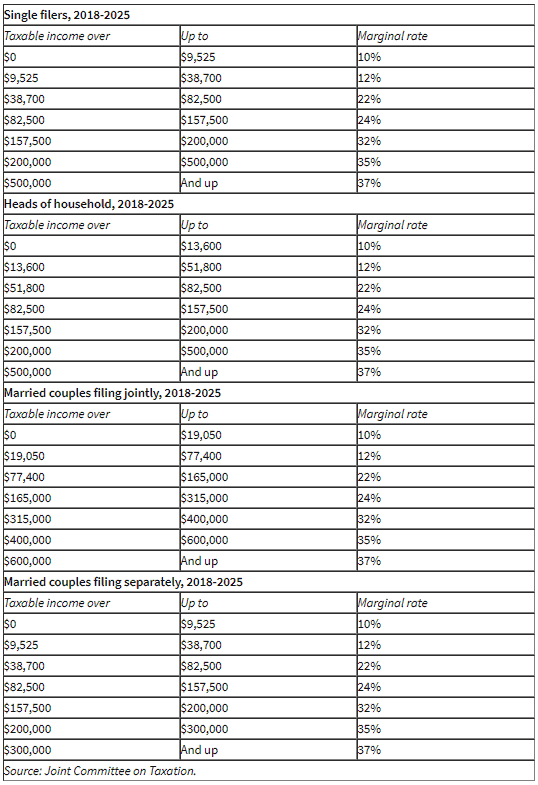

Tax Rates. The bill preserves the current 7 progressive bracket structure, but lowers the marginal rates individuals will pay in most cases. All changes to rates are temporary (slated to expire in 2025). The new rate structure looks like this:

Look here for a review of the 2018 tax tables as they would have been before the passage of this bill.

Standard Deduction & Personal Exemptions. The standard deduction amount is increased to $24,000 for married couples filing jointly, $12,000 for single filers, and $18,000 for heads of household (up from $13,000, $6,500, and $9,550, respectively). This the primary simplification measure of the reform bill: the idea that more taxpayers will elect the standard deduction instead of itemizing and thus have simpler tax returns.

Personal exemptions, which would have been $4,150 each, are eliminated under the new law.

Itemized Deductions

State and Local Tax Deduction. The new law caps the state and local tax deduction at $10,000 through 2025. This cap applies to both income and property taxes as a whole, not separately, so it disproportionally affects married couple filing jointly and people who live in traditionally Democratic (i.e. high tax) states.

Mortgage Interest Deduction. The mortgage interest deduction is applicable only to interest paid on $750,000 of mortgage debt, down from $1,000,000. According to analysis by Forbes, this change means that roughly 64% of homes in the DC metro area are valued high enough for the mortgage interest deduction to be applicable – down from 98% under the old law. The new law eliminates deductible interest on home equity loans.

Miscellaneous Deductions. The new bill eliminates many miscellaneous itemized deductions including home office expenses, union dues, tax prep fees, work uniforms, and professional society dues.

Pease Limitations. The current limits on itemized deductions (3% of AGI or 80% total limits) that apply to high income taxpayers are removed by the new law.

Student Loan Interest Deduction. The student loan interest deduction remains unchanged.

Moving Expenses. Moving expenses to take a new job are not deductible under the new law.

Alimony. Alimony payments for divorces finalized after December 31, 2018, are no longer deductible by the paying ex-spouse nor recognized as income to the receiving ex-spouse. This goes against the traditional thinking that income should be taxed to the person enjoying the benefit of that income, but this change is meant to curb income shifting by higher income individuals to those in a lower tax bracket.

Obamacare Individual Mandate. The new law ends the individual mandate, which compels people to purchase health insurance coverage by penalizing individuals who don’t. The new law technically leaves the individual mandate in place, but reduces the penalty for noncompliance to $0. In reality, this is more of a political maneuver than an economic one, since premiums in most locations are high enough relative to income to exempt most taxpayers from the penalties anyway.

Child Tax Credit. The new law raises the child tax credit to $2,000, with the first $1,400 being refundable (meaning collectable in excess of tax liability), and also creates a nonrefundable $500 credit for non-child dependents (i.e. dependent children who “age out” of the child tax credit, elderly parents, etc. – if you are confused as to who qualifies as a non-child dependent, give me a call). Also, phaseout amounts for the child tax credit are increased to $400,000 of AGI for married couples filing jointly (formerly, the phaseout began at $110,000).

Alternative Minimum Tax (AMT). The new law raises the exemption amounts and phaseout for AMT. For married couples filing jointly, the exemption rises to $109,400 and phases out at $1,000,000. For single taxpayers, the exemption amount is raised to $70,300 and phases out at $500,000. This, coupled with the limits on state and local tax deductions and the disallowance of home equity loan interest, will mean that far fewer taxpayers will be liable for AMT.

Business Taxes

Corporate Taxes. The corporate tax rate is now 21%, down from a previous maximum rate of 35%. The new law eliminates the corporate AMT.

Pass-through Entities. Passthrough entities – partnerships, sole proprietors on Schedule C, and S corps – will have available a 20% deduction for passthrough income. This brings the tax rate of business income more in line with the lower corporate rate. Restrictions apply to certain industries including healthcare, legal, and financial services above income of $157,500 for single taxpayers and $315,000 for married taxpayers filing jointly.

Depreciation of Capital Assets. The new law allows for immediate expensing of capital investments at the entity level on all assets except real estate – this tax break is available in full for 5 years, and then phases out by 20% per year for a 5 year period.

Net Operating Losses (NOLs). NOLs carrybacks are no longer allowed, and carryforwards are capped at 90% of taxable income. After 2022, the maximum carryforward for an NOL is 80% of taxable income.